Balancing Love & Finances: A Financial Roadmap for Family Caregivers

Are you looking for resources and support to help you navigate the financial complexities of caregiving for a loved one?

Being a family caregiver is one of the most selfless acts of love, but it can also feel overwhelming—especially when it comes to managing finances. That’s why we’re inviting you to a free, compassionate workshop designed just for caregivers like you.

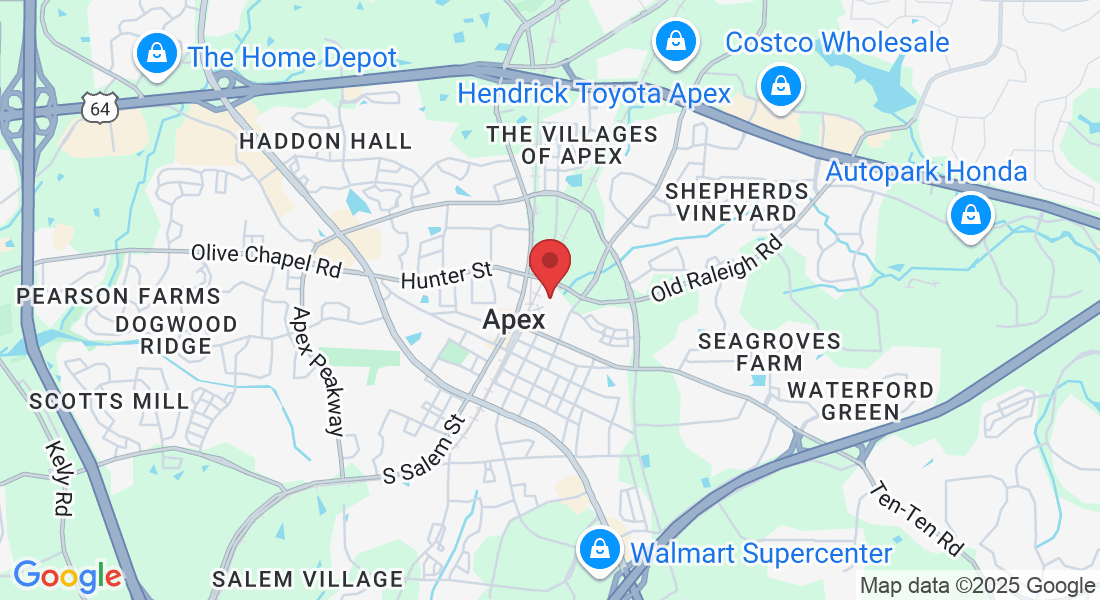

Join us at the Apex Senior Center for a one-hour session dedicated to financial planning as caregivers.

Event Date and Time:

Saturday, March 29th · 10:30am - 11:30am EDT

Reserve Your FREE spot Today!

About this event

Caregiving With Confidence

Discover how to navigate the financial challenges of caregiving at our exclusive workshop hosted by Family Legacy Financial Solutions - one, if not the only, financial services firms devoted to the financial needs of family caregiving.

In just one hour, you’ll gain access to expert insights, actionable strategies, and essential tools designed to help you create a financial plan that works for both your loved ones and yourself. Whether you’re caring for aging parents or loved ones with specific needs, this event will empower you to take control, plan smarter, and feel more confident about the road ahead.

Don't miss this opportunity to invest in your peace of mind. Reserve your spot today—space is limited!

This Educational Workshop will Provide You With Valuable Information and Actionable insights You can implement immediately!

Event Highlights: What You’ll Gain from Attending:

Family Legacy's own Chief Behavioral Officer, Michael Lewis, CFA will share with you best practices on how to create a secure environment for managing the personal finances for someone you love. He will answer your questions on a wide range of topics which include:

Reduce Caregiving Stress: Learn practical strategies to ease the emotional and financial burdens of caregiving responsibilities.

Navigate the Caregiving Ecosystem: Identify key stakeholders and understand their roles to build a strong support network.

Protect Against Fraud: Spot the warning signs and take proactive steps to safeguard your loved ones from financial abuse.

Plan for the Cost of Care: Access proven strategies and resources to prepare for current and future expenses.

Master Financial Caregiving: Understand the full scope of a financial caregiver’s responsibilities and how to manage them effectively.

Leverage Technology: Discover tools and apps that simplify caregiving and improve financial planning.

Avoid Costly Mistakes: Learn the impact of bad, delayed, or avoided decisions—and how to make informed choices instead.

Event attendees will receive a free copy of "The Caregivers Advocate" for which Michael is a contributing author.

Look forward to seeing you there!

Advisory services provided by Family Legacy Financial Solutions, LLC, a Registered Investment Advisor. Investment Advisor Representatives of Family Legacy Financial Solutions have a fiduciary duty to act in the best interests of our clients and to disclose any conflicts of interests and any associated fees.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals (Family Legacy Tax Solutions LLC) for specific information regarding your individual situation. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security. This site is published for residents of the United States only. Not all of the products and services referenced on this site may be available in every state and through every representative listed.

Family Legacy Financial Solutions.

CA, CO, FL, IA, IL MA, MO, MS, NC, NH, TX, VA, WA